If you believe everything you read on the internet, electric cars are going to bring about the death of the entire oil industry by 2020. But falling demand for gasoline alone won’t cause layoffs in the energy industry. Oil and gas producers are more resilient than critics give them credit for, and here’s why.

Adoption Will Be Slow

Even if battery prices fall dramatically, electric vehicle adoption won’t happen overnight. The first hurdle that electric cars need to clear is widespread fleet adoption. On average, fleet turnover tends to be slower than the consumer average.

Buying a fleet of vehicles is a huge investment, and companies take care of that investment with regular maintenance and professional repairs. Fleet vehicles stay on the road longer. According to some estimates, it takes 10 years to replace a fleet.

Consumers don’t typically hold onto their cars for that long, but many more people buy used cars than new.

Technology adoption is never as fast or as complete as the early promises make it out to be. America Online still has 2 million dial-up subscribers.

Demand Shifted to Power Generation

If the forecasts are right, demand for electric vehicles will grow to 41 million units in 2040. All of those additional electric vehicles on the road will need the equivalent of 8% of today’s overall electrical grid capacity to recharge.

That’s a lot of electricity, and it has to come from somewhere.

Some of it will come from renewable sources, but a lot of it won’t. Green energy has promise, but at this point it takes more energy to create than it yields. The ratio of energy returned by a fuel as compared to energy expended in producing it is called EROEI. Aside from hydroelectric power, fossil fuels are still the clear leader in EROEI.

That’s important, because as our demand for grid electricity increases, America needs to meet the challenge with the most efficient fuel sources available. As of right now, that means oil and natural gas.

A lot of the demand for fossil fuels will shift to power generation, it won’t just disappear.

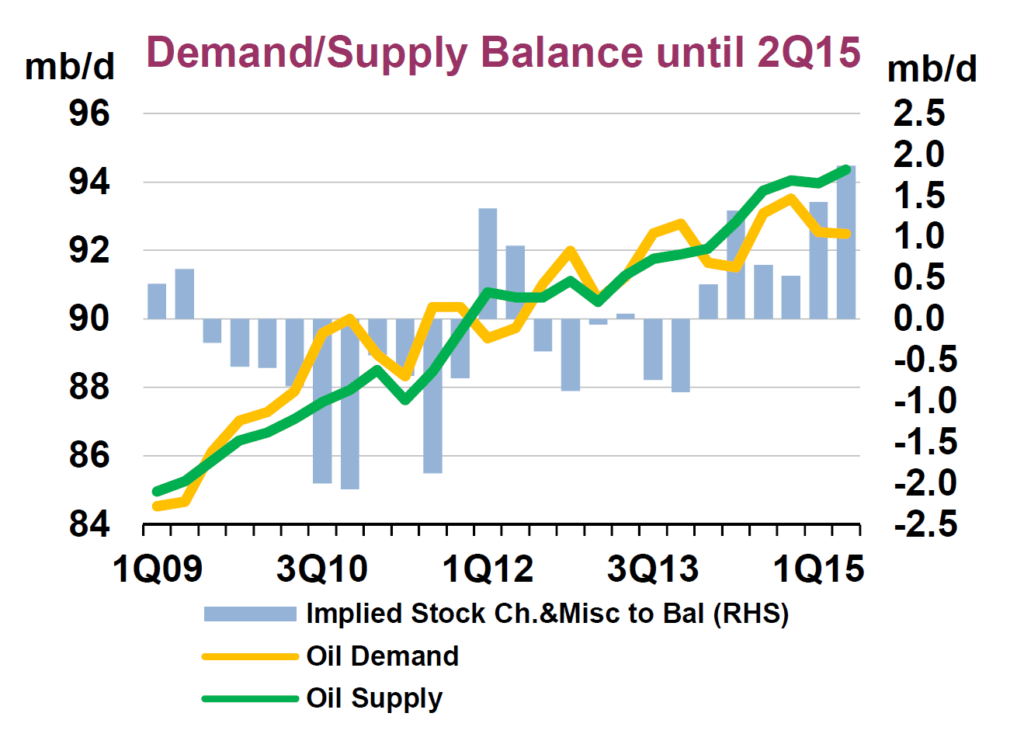

Flattening Demand Doesn’t Mean Cheaper Crude

To be clear, even with a shift in demand we’re going to be using less oil when electric vehicles are on every road and highway. But a drop in demand doesn’t automatically mean a drop in price, as long as supply is managed properly.

When you look at how traditional oil wells were built, you’ll see that most of the cost was borne upfront. Locating and boring the well was the most expensive part of the whole enterprise.

Oil producers didn’t stop pumping just because demand flattened. They’d already paid the price, so it made sense to continue operations even if they were making pennies on the dollar.

But now we’re utilizing new technologies like fracking, which is much more agile. Fracked wells cost less to drill and operate.

Fracked wells also tend to run dry in about 12 – 18 months, which isn’t necessarily a bad thing. Strictly in terms of keeping the oil supply elastic to keep pace with demand, there are a lot of advantages to using cheaper wells that play out faster.

As long as falling demand can be matched with a responsive supply, oil prices can be held stable.

Petroleum isn’t an Element

Imagine that a new metal is discovered that’s cheap, abundant, lightweight, and a perfect electrical conductor. The price of aluminum and copper would fall overnight, and the mining industry would be changed forever.

That’s what some proponents of electric vehicles think will happen to the fossil fuel industry when electric cars, cheap lithium-ion batteries, and super-efficient solar cells hit the market.

But those people completely misunderstand petroleum and its versatility. Crude oil is a blend of different hydrocarbons, all of them useful. If the public is buying less gasoline, refiners will adjust. They might produce more butane, or naphthalene, or toluene — the hydrocarbons that used to be used to create gasoline blends can just as easily be sold to other industries.

If gasoline demand falls and stays down, refineries have every incentive to change what they produce.

That spreads out the impact of lowered demand from one application to hundreds. With less people buying gasoline, advanced plastics would get cheaper. Jet fuel prices would fall. The excess supply would be absorbed elsewhere.

Hydrocarbons are needed in so many modern industries that it will take more than electric cars hitting the road to slow down the oil and gas producers in any meaningful way.

Electric Cars are Coming Eventually

It’s going to take longer than most people think, and the impact on the oil industry won’t be as dramatic as some say, but electric vehicles are coming.

And that’s not a bad thing.

If people can figure out a better way to get where they need to go, and drive down transportation costs in the process, that’s a win for oil and gas workers and their families.

The industry is full of scientists and technicians who embrace technology, and next-generation cars are going to be exciting and new… But they’re not going to put energy companies out of business, or cause a commodity collapse, or hurt oil and gas jobs in the process.

This is a similar idea to another that I read and I quite appreciate the sentiment. I think the threat of EV’s is exaggerated. I hope that this is the case. After all, it’s not only cars that run on oil. There is a whole world outside of our vehicles dependent on oil

http://oilprice.com/Energy/Energy-General/The-EV-Myth-Electric-Car-Threat-To-Oil-Is-Wildly-Overstated.html

Yea… for sure

I will not sell my oil stocks anytime soon!