Over the past couple weeks, we read a half dozen transcripts of earnings calls from the oil majors and national oil companies (NOCs). The big guys are all whistling the same tune.

They are successfully re-engineering pending deepwater projects to fit $50 oil (and below). They are ready to clear their final investment decision (FID) pipelines of big field development projects that have been stranded for the past several years by the oil price collapse. And a large and growing list of pre-FID deepwater projects now tout break evens as good or better than the Permian Basin.

It has taken deepwater operators longer than the tight oil crowd to figure out how to adapt to $50 oil. But during the past few quarters, the majors have made some tremendous strides. Although FIDs have been few and far between over the past several years, the playing field is starting to skew more positive following this re-tooling. A flurry of sanctions by 2018 is increasingly likely.

Critics will say that depressed input costs are unsustainable and point to execution risk on big promises being made by the majors. We acknowledge and share these concerns. And future offshore cycles will certainly come with less extravagant addressable markets.

When the upcycle begins, the pie will be smaller. Gone are the days of extravagance in engineering, iron, and design. Projects will be more challenging and cost overruns less acceptable. Welcome to growth at $50 oil. But shallow growth beats no growth at all.

The major’s tone shift in their 2017 outlooks is just the foundation. This won’t immediately translate into a windfall of drilling work and equipment orders. Things happen slower offshore, and the drillers will still be left waiting for 2020 in our view. But importantly, the kind of breakthroughs the majors are talking about today could set the stage for the return of field development activity growth at the current strip.

OPEC’s strategy will have completely backfired if first tight oil and now deepwater production can grow again at $50 oil. The cartel may have made a grave miscalculation by providing a catalyst for Western E&Ps to clean up a decade of largesse. Abandoning price protection may ultimately cost OPEC in both lower-for-longer oil prices AND much leaner, stronger competitors. Of course, there’s still much to be proven before we can put this conclusion in the history books.

We now expect the majors’ clogged FID pipeline will begin to clear as projects are sanctioned over the next 12-24 months, absent a slide back below $40 per barrel. As we write, the blurry image of a future recovery in offshore field development is beginning to sharpen. Higher oil prices are not required. Here is why.

To Spot Deepwater Inflection, You Must Listen To The Majors

Two engines drive the outlook for deepwater activity these days – the majors and the National Oil Companies (NOCs). On a list of 150 pre-FID field development projects we studied this week, majors operate 35% and NOCs 34%. In many cases where the NOCs operate, the majors partner and lend technical expertise.

International independents are still engaged (to a lesser extent), but the US Independents have largely fled the offshore arena for the allure of making a quick buck in tight oil. So if you want to know when the offshore field development market might start to recover, you have to listen closely to the majors.

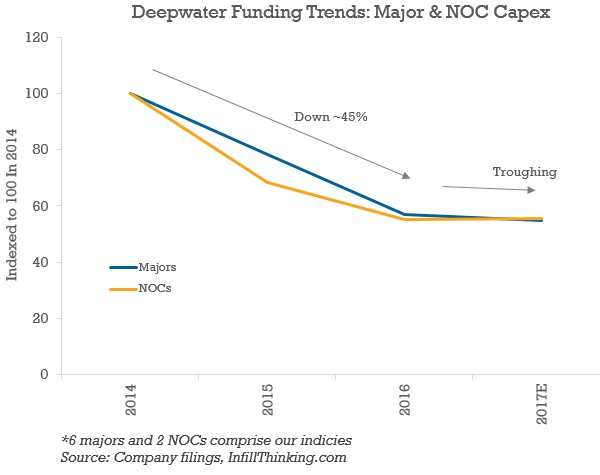

A glance at investment trends among these two operator camps shows why many service providers have asked internally “is deepwater dead?” As overall spending starts to trough in 2017, field development spending is still declining a bit in the mix. That said, the cuts are decelerating significantly.

Pinpoint the inflection in this chart, and you’ll be pretty close to identifying the turning point in the fortune of the deepwater marketplace.

We believe the majors are increasingly concerned about looming declines in the development project production wedge. Neglect field development for several years, and production declines will start to snowball.

The only way to fix this is to start ramping spending, and that could happen as early as next year. For example, Repsol acknowledged this week that they will have to raise spending to €4.0bn in 2018 and onwards from €3.6bn this year in order to sustain production targets and keep a 100% reserve replacement ratio.

Deepwater Break Evens Starting To Look Like The Permian Basin (Or Better)

By resetting their cost base (with big advances in 2016), the majors/NOCs greatly expanded their opportunity set in a lower-for-longer scenario. Deepwater break evens are frequently being pegged below $50 oil now. Total expects to bring “a number” of projects to FID over the next 18 months. Specifically, management mentioned 10 projects – half are large and most are deepwater – they are focused on today. The company also highlighted a sustainable cost reduction of $2.8bn from the peak and is looking to add a further $1.2bn in efficiency gains through 2018.

Meanwhile, Shell said they have a decade of inventory in the sub-$40 and in some cases sub-$30 range in deepwater. Shell also sees break evens in Brazil well below $40/barrel across the board. CEO Ben van Beurden said he is ready to grow in deepwater now, not at some point in the future. When asked about shale vs. deepwater, Ben made the following case for deepwater:

“We need both characteristics in our portfolio. What we like about the deepwater business is indeed the very high free cash flow generative nature of it, once you pass the investment hump, which gives a lot of resilience of course for the portfolio when it is stable… [Compared to shale] they complement each other and that’s why we want to have roughly comparable strength, I wouldn’t say equal strength, in both of them.”

Shell specifically mentioned the Kaikias project in the Gulf of Mexico as one that they expect to FID in the near term. Shell has lowered the break even price to below $40 for this project which will reach a peak production rate of 40,000 b/d.

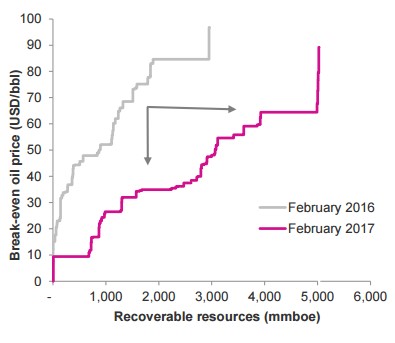

Shell’s work is impressive, but Statoil’s pipeline is hard to top. This chart from Statoil’s capital markets update this month is absolutely staggering. It depicts the company’s total non-sanctioned portfolio (operated and non-operated), and you can see Statoil has almost a billion boe project in the pipeline that breaks even at $10. It also paints a completely different economic picture than existed at this time a year ago – look how that curve has dropped.

Statoil now has a “new generation portfolio” that works at $27 per barrel. One year ago, the company’s non-sanctioned portfolio broke even at about $41 per barrel. That’s what step change looks like folks.

The other majors aren’t far behind…

Read the full report to see what levers the majors are pulling to put deepwater back in play >> (free trial required)

The full story was originally published by Infill Thinking on February 23, 2017

About the source of this post: Joseph Triepke created Infill Thinking in 2016 to deliver high-caliber oilfield research updates to O&G decision makers. No ads. No clutter. No noise. Just research on the trends that matter most delivered to subscriber inboxes. Use the coupon code DrillersDotCom when you sign up to get 15% off the subscription cost.

feature image credit statoil

Great article! I’ve had some very positive feedback about this particular piece.

Thanks, Dave! It’s great to hear from you and I’m glad to hear that…